We’ve Got Mail!

While we started out in real estate investing to make a profit from a business, we didn’t completely realize in the beginning how much fun we’d have by helping others and making an impact.

5 Reasons Owners Offer Seller Financing

Why would a seller allow a buyer to make payments over time for the purchase of property? Wouldn’t the seller rather get paid now and require the buyer to obtain a bank loan?

A Guide to Calculating Returns on Investment (ROI)

Return on investment (ROI) is a financial metric that is widely used to measure the probability of gaining a return from an investment. It is a ratio that compares the gain or less from an investment relative to its. cost. It is useful in evaluating the potential return from a stand-alone investment as it is in comparing returns from several investments.

What is the Loan-to-Value (LTV) Ratio

The loan-to-value (LTV) ratio is an assessment of leading risk that financial institutions and other lenders examine before approving a mortgage. Typically, loan assessments with high LTV ratios are considered higher risk loans. Therefore, if the mortgage is approved, the loan has a higher interest rate.

What Is the Loan-to-Value (LTV) Ratio?

The loan-to-value (LTV) ratio is an assessment of lending risk that financial institutions and other lenders examine before approving a mortgage. Typically, loan assessments with high LTV ratios are considered higher risk loans. Therefore, if the mortgage is approved, the loan has a higher interest rate.

Key Takeaways

Loan-to-value (LTV) is an often used ratio in mortgage lending to determine the amount necessary to put in a down-payment and whether a lender will extend credit to a borrower. Most lenders offer mortgage and home-equity applicants the lowest possible interest rate when the loan-to-value ratio is at or below 80%.

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible mortgage programs for low- income borrowers allow an LTV ratio of 97% (3% down payment) but require mortgage insurance until the ratio falls to 80%.

Understanding the Loan-to-Value (LTV) Ratio

Interested homebuyers can easily calculate the LTV ratio of a home. This is the formula:

\begin{aligned} <V ratio=\frac{MA}{APV}\\ &\textbf{where:}\\ &MA = \text{Mortgage Amount}\\ &APV = \text{Appraised Property Value}\\ \end{aligned}

where:Mortgage AmountAppraised Property Value

An LTV ratio is calculated by dividing the amount borrowed by the appraised[2] value of the property, expressed as a percentage. For example, if you buy a home appraised at $100,000 for its appraised value, and make a $10,000 down payment[3], you will borrow $90,000. This results in an LTV ratio of 90% (i.e., 90,000/100,000).

Determining an LTV ratio is a critical component of mortgage underwriting[4]. It may be used in the process of buying a home[5], refinancing[6] a current mortgage into a new loan, or borrowing against accumulated equity[7] within a property.

Lenders assess the LTV ratio to determine the level of exposure to risk they take on when underwriting a mortgage. When borrowers request a loan for an amount that is at or near the appraised value (and therefore has a higher LTV ratio), lenders perceive that there is a greater chance of the loan going into default[8]. This is because there is very little equity built up within the property. As a result, in the event of a foreclosure[9], the lender may find it difficult to sell the home for enough to cover the outstanding mortgage balance and still make a profit from the transaction.

The main factors that impact LTV ratios are the amount of the down payment, sales price, and the appraised value of a property. The lowest LTV ratio is achieved with a higher down payment and a lower sales price.

How LTV is Used by Lenders

A LTV ratio is only one factor in determining eligibility for securing a mortgage, a home-equity loan[10], or a line of credit[11]. However, it can play a substantial role in the interest rate that a borrower is able to secure.

Most lenders offer mortgage and home-equity applicants the lowest possible interest rate when their LTV ratio is at or below 80%. A higher LTV ratio does not exclude borrowers from being approved for a mortgage, although the interest on the loan may rise as the LTV ratio increases. For example, a borrower with an LTV ratio of 95% may be approved for a mortgage. However, their interest rate may be a full percentage point higher than the interest rate given to a borrower with an LTV ratio of 75%.

If the LTV ratio is higher than 80%, a borrower may be required to purchase private mortgage insurance (PMI)[12]. This can add anywhere from 0.5% to 1% to the total amount of the loan on an annual basis. For example, PMI with a rate of 1% on a $100,000 loan would add an additional

$1,000 to the total amount paid per year (or $83.33 per month). PMI payments are required until the LTV ratio is 80% or lower. The LTV ratio will decrease as you pay down your loan and as the value of your home increases over time.

In general, the lower the LTV ratio, the greater the chance that the loan will be approved and the lower the interest rate is likely to be. In addition, as a borrower, it’s less likely that you will be required to purchase private mortgage insurance (PMI).

While it is not a law that lenders require an 80% LTV ratio in order for borrowers to avoid the additional cost of PMI, it is the practice of nearly all lenders. Exceptions to this requirement are sometimes made for borrowers who have a high income, lower debt, or have a large investment portfolio.

Example of LTV

For example, suppose you buy a home that appraises for $100,000. However, the owner is willing to sell it for $90,000. If you make a $10,000 down payment, your loan is for $80,000, which results in an LTV ratio of 80% (i.e., 80,000/100,000). If you were to increase the amount of your down payment to $15,000, your mortgage loan is now $75,000. This would make your LTV ratio 75% (i.e., 75,000/100,000).

Variations on Loan-to-Value Ratio Rules

Different loan types may have different rules when it comes to LTV ratio requirements.

FHA Loans

FHA loans are mortgages designed for low-to-moderate-income borrowers. They are issued by an FHA-approved lender and insured by the Federal Housing Administration (FHA)[13]. FHA loans require a lower minimum down payment and credit scores than many conventional loans. FHA loans allow an initial LTV ratio of up to 96.5%, but they require a mortgage insurance premium (MIP)[14] that lasts for as long as you have that loan (no matter how low the LTV ratio eventually goes). Many people decide to refinance their FHA loans once their LTV ratio reaches 80% in order to eliminate the MIP requirement.

VA and USDA Loans

VA and USDA loans—available to current and former military or those in rural areas—do not require private mortgage insurance even though the LTV ratio can be as high as 100%. However, both VA and USDA loans do have additional fees.

Fannie Mae and Freddie Mac

Fannie Mae’s HomeReady and Freddie Mac’s Home Possible mortgage programs for low-income borrowers allow an LTV ratio of 97%. However, they require mortgage insurance until the ratio falls to 80%.

For FHA, VA, and USDA loans, there are streamline refinancing options available. These waive appraisal requirements so the home’s LTV ratio doesn’t affect the loan. For borrowers with an LTV ratio over 100%—also known as being “underwater” or “upside down”—Fannie Mae’s High Loan-to-Value Refinance Option and Freddie Mac’s Enhanced Relief Refinance are also available options.

LTV vs. Combined LTV (CLTV)

While the LTV ratio looks at the impact of a single mortgage loan when purchasing a property, the combined loan-to-value[15] (CLTV) ratio is the ratio of allsecured loans on a property to the value of a property. This includes not only the primary mortgage used in LTV but also any second mortgages, home equity loans or lines of credit, or other liens. Lenders use the CLTV ratio to determine a prospective home buyer’s risk of default when more than one loan is used— for example, if they will have two or more mortgages, or a mortgage plus a home equity loan or line of credit (HELOC). In general, lenders are willing to lend at CLTV ratios of 80% and above and to borrowers with high credit ratings. Primary lenders tend to be more generous with CLTV requirements since it is a more thorough measure.

Let’s look a little closer at the difference. The LTV ratio only considers the primary mortgage balance on a home. Therefore, if the primary mortgage balance is $100,000 and the home value is $200,000, LTV = 50%.

Consider, however, the example if it also has a second mortgage in the amount of $30,000 and a HELOC of $20,000. The combined loan to value now becomes ($100,000 + $30,000 + $20,000 / $200,000) = 75%; a much higher ratio.

These combined considerations are especially important if the mortgagee defaults and foes into foreclosure.

Disadvantages of Loan-to-Value (LTV)

The main drawback of the information that a LTV provides is that it only includes the primary mortgage that a homeowner owes, and does not include in its calculations other obligations of the borrower, such as a second mortgage or home equity loan. Therefore, the CLTV is a more inclusive measure of a borrower’s ability to repay a home loan.

Links

- https://www.investopedia.com/terms/m/mortgage-insurance.asp

- https://www.investopedia.com/terms/a/appraisal.asp

- https://www.investopedia.com/terms/d/down_payment.asp

- https://www.investopedia.com/terms/u/underwriting.asp

- https://www.investopedia.com/articles/personal-finance/111214/buying-home-cash-vs- asp

- https://www.investopedia.com/terms/r/refinance.asp

- https://www.investopedia.com/terms/e/equity.asp

- https://www.investopedia.com/terms/d/default2.asp

- https://www.investopedia.com/terms/f/foreclosure.asp

- https://www.investopedia.com/terms/h/homeequityloan.asp

- https://www.investopedia.com/terms/l/lineofcredit.asp

- https://www.investopedia.com/mortgage/mortgage-guide/mortgage-insurance/

- https://www.investopedia.com/terms/f/federal-housing-administration.asp

- https://www.investopedia.com/mortgage/insurance/qualified-insurance-premium/

- https://www.investopedia.com/terms/c/combinedloantovalue.asp

A Guide to Calculating Return on Investment (ROI)

By Andrew Beattie[1] Updated Aug 31, 2020

Return on investment (ROI)[2] is a financial metric that is widely used to measure the probability of gaining a return from an investment. It is a ratio that compares the gain or loss from an investment relative to its cost. It is as useful in evaluating the potential return from a stand-alone investment as it is in comparing returns from several investments.

In business analysis, ROI and other cash flow measures—such as internal rate of return (IRR)[3] and net present value (NPV)[4]—are key metrics that are used to evaluate and rank the attractiveness of a number of different investment alternatives. Although ROI is a ratio, it is typically expressed as a percentage rather than as a ratio.

Key Takeaways

Return on investment (ROI) is an approximate measure of an investment’s profitability. ROI has a wide range of applications; it can be used to measure the profitability of a stock investment, when deciding whether or not to invest in the purchase of a business, or evaluate the results of a real estate transaction.

ROI is calculated by subtracting the initial value of the investment from the final value of the investment (which equals the net return), then dividing this new number (the net return) by the cost of the investment, and, finally, multiplying it by 100.

ROI is relatively easy to calculate and understand, and its simplicity means that it is a standardized, universal measure of profitability.

One disadvantage of ROI is that it doesn’t account for how long an investment is held; so, a profitability measure that incorporates the holding period may be more useful for an investor that wants to compare potential investments.

How to Calculate Return on Investment (ROI)

ROI can be calculated using two different methods. First method:

ROI = \frac{\text{Net\ Return \ on \ Investment}}{\text{Cost \ of \ Investment}}\times 100\% Cost of InvestmentNet Return on Investment

Second method:

ROI = \frac{\text{Final Value of Investment}\ -\ \text{Initial Value of Investment}}{\text{Cost of Investment}}\times100\%

Cost of InvestmentFinal Value of InvestmentInitial Value of Investment

Interpreting the Return on Investment (ROI)

When interpreting ROI calculations, it’s important to keep a few things in mind. First, ROI is typically expressed as a percentage because it is intuitively easier to understand (as opposed to when expressed as a ratio). Second, the ROI calculation includes the net return in the numerator because returns from an investment can be either positive or negative.

When ROI calculations yield a positive figure, it means that net returns are in the black (because total returns exceed total costs). Alternatively, when ROI calculations yield a negative figure, it means that net returns are in the red[5] because total costs exceed total returns. (In other words, this investment produces a loss.) Finally, to calculate ROI with the highest degree of accuracy, total returns and total costs should be considered. For an apples-to-apples comparison between competing investments, annualized ROI should be considered.

Return on Investment (ROI) Example

Assume an investor bought 1,000 shares of the hypothetical company Worldwide Wicket Co. at

$10 per share. One year later, the investor sold the shares for $12.50. The investor earned dividends[6] of $500 over the one-year holding period[7]. The investor also spent a total of $125 on trading commissions[8] in order to buy and sell the shares.

The ROI for this investor can be calculated as follows:

ROI = ([($12.50 – $10.00) * 1000 + $500 – $125] ÷ ($10.00 * 1000)) * 100 = 28.75%

Here is a step-by-step analysis of the calculation:

- To calculate net returns, total returns and total costs must be considered. Total returns for a stock result from capital gains[9] and dividends. Total costs would include the initial purchase price as well as any commissions

- In the above calculation, the gross capital gain (before commissions) from this trade is ($12.50 – $10.00) x 1,000. The $500 amount refers to the dividends received by holding the stock, while $125 is the total commissions.

If you further dissect the ROI into its component parts, it is revealed that 23.75% came from capital gains and 5% came from dividends. This distinction is important because capital gains and dividends are taxed at different rates in most jurisdictions.

ROI = Gross Capital Gains % – Commission % + Dividend Yield[10]

Gross Capital Gains = $2500 ÷ $10,000 * 100 = 25.00% Commissions = $125 ÷ $10,000 * 100 = 1.25%

Dividend Yield = $500 ÷ $10,000 * 100 = 5.00% ROI = 25.00% – 1.25% + 5.00% = 28.75%

A positive ROI means that net returns are positive because total returns are greater than any associated costs; a negative ROI indicates that net returns are negative: total costs are greater than returns.

An Alternative Return on Investment (ROI) Calculation

If, for example, commissions were split, there is an alternative method of calculating this hypothetical investor’s ROI for their Worldwide Wicket Co. investment. Assume the following split in the total commissions: $50 when buying the shares and $75 when selling the shares.

IVI = $10,000 + $50 = $10,050

FVI = $12,500 + $500 – $75 = $12,925

ROI = [($12,925 – $10,050) ÷ $10,000] * 100 = 28.75%

In this formula, IVI refers to the initial value of the investment (or the cost of the investment). FVI refers to the final value of the investment.

Annualized ROI helps account for a key omission in standard ROI—namely, how long an investment is held.

Annualized Return on Investment (ROI)

The annualized ROI calculation provides a solution for one of the key limitations of the basic ROI calculation; the basic ROI calculation does not take into account the length of time that an investment is held, also referred to as the holding period. The formula for calculating annualized ROI is as follows:

\begin{aligned} &\text{Annualized } ROI = [(1 + ROI) ^{1/n} – 1]\times100\%\\ &\textbf{where:}\\ &\begin{aligned} n=\ &\text{Number of years for which the investment}\\ &\text{is held} \end{aligned} \end{aligned}

Annualized where:Number of years for which the investmentis held

Assume a hypothetical investment that generated an ROI of 50% over five years. The simple annual average ROI of 10%–which was obtained by dividing ROI by the holding period of five years–is only a rough approximation of annualized ROI. This is because it ignores the effects of compounding[11], which can make a significant difference over time. The longer the time period, the bigger the difference between the approximate annual average ROI, which is calculated by dividing the ROI by the holding period in this scenario, and annualized ROI.

\begin{aligned} &\text{From the formula above,}\\ &\text{Annualized ROI}= [(1+0.50)^{1/5}-1]\times100\%=8.45\% \end{aligned}

From the formula above,Annualized ROI

This calculation can also be used for holding periods of less than a year by converting the holding period to a fraction of a year.

Assume an investment that generated an ROI of 10% over six months.

\text{Annualized ROI}=[(1+0.10)^{1/0.5}-1]\times100\%=21.00\%Annualized ROI In the equation above, the numeral 0.5 years is equivalent to six months.

Comparing Investments and Annualized Returns on Investment (ROI)

Annualized ROI is especially useful when comparing returns between various investments or evaluating different investments.

Assume that an investment in stock X generated an ROI of 50% over five years, while an investment in stock Y returned 30% over three years. You can determine what the better investment was in terms of ROI by using this equation:

\begin{aligned} &AROIX=[(1+0.50)^{1/5}-1]\times100\%=8.45\%\\ &AROIY=

[(1+0.30)^{1/3}-1]\times100\%=9.14\%\\ &\textbf{where:}\\ &AROIX = \text{Annualized ROI for stock }X\\ &AROIY = \text{Annualized ROI for stock }Y \end{aligned}

where:Annualized ROI for stock Annualized ROI for stock

According to this calculation, stock Y had a superior ROI compared to stock X.

Combining Leverage with Return on Investment (ROI)

Leverage[12] can magnify ROI if the investment generates gains. However, by the same token, leverage can also amplify losses if the investment proves to be a losing investment.

Assume that an investor bought 1,000 shares of the hypothetical company Worldwide Wickets Co. at $10 per share. Assume also that the investor bought these shares on a 50% margin[13] (meaning they invested $5,000 of their own capital and borrowed $5,000 from their brokerage firm as a margin loan). Exactly one year later, this investor sold their shares for $12.50. They earned dividends of $500 over the one-year holding period. They also spent a total of $125 on trading commissions when they bought and sold the shares. In addition, their margin loan carried an interest rate[14] of 9%.

When calculating the ROI on this specific, hypothetical investment, there are a few important things to keep in mind. First, in this example, the interest[15] on the margin loan ($450) should be considered in total costs.Second, the initial investment is now $5,000 because of the leverage employed by taking the margin loan of $5,000.

ROI = [($12.50 – $10)*1000 + $500 – $125 – $450] ÷ [($10*1000) – ($10*500)] * 100 = 48.5%

Thus, even though the net dollar return was reduced by $450 on account of the margin interest, ROI is still substantially higher at 48.50% (compared with 28.75% if no leverage was employed).

As an additional example, consider if the share price fell to $8.00 instead of rising to $12.50. In this situation, the investor decides to cut their losses and sell the full position. Here is the calculation for ROI in this scenario:

\begin{aligned} \text{ROI}=&\frac{[(\$8.00-\$10.00)\times1,000]+\$500-\$125-\$450}

{(\$10.00\times1,000)-(\$10.00\times500)}\\ &\times100\%=-\frac{\$2,075}{\$5,000} =-41.50\%

\end{aligned}

In this case, the ROI of -41.50% is much worse than an ROI of -16.25%, which would have occurred if no leverage was employed.

The Problem of Unequal Cash Flows

When evaluating a business proposal, it’s possible that you will be contending with unequal cash flows. In this scenario, ROI may fluctuate from one year to the next.

This type of ROI calculation is more complicated because it involves using the internal rate of return (IRR) function in a spreadsheet or calculator.

Assume you are evaluating a business proposal that involves an initial investment of $100,000 (This figure is shown under the “Year 0” column in the “Cash Outflow” row in the following table). This investment will generate cash flows over the next five years; this is shown in the “Cash Inflow” row. The row called “Net Cash Flow” sums up the cash outflow and cash inflow for each year.

IMAGE

Image by Sabrina Jiang © Investopedia 2020

Using the IRR function, the calculated ROI is 8.64%.

The final column shows the total cash flows over the five-year period. Net cash flow over this five-year period is $25,000 on an initial investment of $100,000. If this $25,000 was spread out equally over five years, the cash flow table would then look like this:

Image

Image by Sabrina Jiang © Investopedia 2020 In this case, the IRR is now only 5.00%.

The substantial difference in the IRR between these two scenarios—despite the initial investment and total net cash flows being the same in both cases—has to do with the timing of

the cash inflows. In the first case, substantially larger cash inflows are received in the first four years. Because of the time value of money[16], these larger inflows in the earlier years have a positive impact on IRR.

Advantages of Return on Investment (ROI)

The biggest benefit of ROI is that it is a relatively uncomplicated metric; it is easy to calculate and intuitively easy to understand. ROI’s simplicity means that it is often used as a standard, universal measure of profitability. As a measurement, it is not likely to be misunderstood or misinterpreted because it has the same connotations in every context.

Disadvantages of Return on Investment (ROI)

There are also some disadvantages of the ROI measurement. First, it does not take into account the holding period of an investment, which can be an issue when comparing investment alternatives. For example, assume investment X generates an ROI of 25%, while investment Y produces an ROI of 15%. One cannot assume that X is the superior investment unless the time- frame of each investment is also known. It’s possible that the 25% ROI from investment X was generated over a period of five years, but the 15% ROI from investment Y was generated in only one year. Calculating annualized ROI can overcome this hurdle when comparing investment choices.

Second, ROI does not adjust for risk. It is common knowledge that investment returns have a direct correlation with risk: the higher the potential returns, the greater the possible risk. This can be observed firsthand in the investment world, where small-cap[17] stocks typically have higher returns than large-cap[18] stocks (but are accompanied by significantly greater risk). An investor who is targeting a portfolio return of 12%, for example, would have to assume a substantially higher degree of risk than an investor whose goal is a return of only 4%. If an investor hones in on only the ROI number without also evaluating the concomitant risk, the eventual outcome of the investment decision may be very different from the expected result.

Third, ROI figures can be exaggerated if all the expected costs are not included in the calculation. This can happen either deliberately or inadvertently. For example, in evaluating the ROI on a piece of real estate[19], all associated expenses should be considered. These include mortgage interest[20], property taxes[21], insurance, and all costs of maintenance. These expenses can subtract a large amount from the expected ROI; without including all of them in the calculation, a ROI figure can be grossly overstated.

Finally, like many profitability metrics, ROI only emphasizes financial gains when considering the returns on an investment. It does not consider ancillary benefits, such as social or environmental goods. A relatively new ROI metric, known as Social Return on Investment (SROI)[22], helps to quantify some of these benefits for investors.

How to Calculate ROI in Excel

The Bottom Line

Return on investment (ROI) is a simple and intuitive metric of the profitability of an investment. There are some limitations to this metric, including that it does not consider the holding period of an investment and is not adjusted for risk. However, despite these limitations, ROI is still a key metric used by business analysts to evaluate and rank investment alternatives.

Links

- https://www.investopedia.com/contributors/82/

- https://www.investopedia.com/terms/r/returnoninvestment.asp

- https://www.investopedia.com/terms/i/irr.asp

- https://www.investopedia.com/terms/n/npv.asp

- https://www.investopedia.com/terms/r/red.asp

- https://www.investopedia.com/terms/d/dividend.asp

- https://www.investopedia.com/terms/h/holdingperiod.asp

- https://www.investopedia.com/terms/c/commission.asp

- https://www.investopedia.com/terms/c/capitalgain.asp

- https://www.investopedia.com/terms/d/dividendyield.asp

- https://www.investopedia.com/terms/c/compounding.asp

- https://www.investopedia.com/terms/l/leverage.asp

- https://www.investopedia.com/terms/m/margin.asp

- https://www.investopedia.com/terms/i/interestrate.asp

- https://www.investopedia.com/terms/i/interest.asp

- https://www.investopedia.com/terms/t/timevalueofmoney.asp

- https://www.investopedia.com/terms/s/small-cap.asp

- https://www.investopedia.com/terms/l/large-cap.asp

- https://www.investopedia.com/terms/r/realestate.asp

- https://www.investopedia.com/terms/m/mortgageinterest.asp

- https://www.investopedia.com/terms/p/propertytax.asp

- https://www.investopedia.com/ask/answers/070314/what-factors-go-calculating-social- return-investment-sroi.asp

5 Reasons Owners Offer Seller Financing

- Why would a seller allow a buyer to make payments over time for the purchase of property?

- Wouldn’t the seller rather get paid now and require the buyer to obtain a bank loan?

Here are 5 reasons property owners offer seller financing:

- Reduced Marketing Times

What is the first thing a real estate agent does when property is not moving and has been on the market for 60 to 90 days? They reduce the price and add the tagline “price reduced” to all advertising and signs. Rather than reduce the price, it might be beneficial for the seller to offer financing. Buyers provided with financing can certainly pay full price in exchange for the many benefits they receive with owner financing, including the money they save by not paying expensive loan fees, origination fees, and points.

- Increased Inventory of Prospective Purchasers

By offering owner financing, the seller increases marketability with a wider group of available purchasers. Statistics show that almost 40 percent of the American population is unable to qualify for traditional bank financing. While not all of the “unqualified” group would be an acceptable risk for owner financing, it still widens the market of prospective buyers considerably. Anyone who has added the words “Owner Will Finance” or “Easy Terms” to a For Sale ad or Multiple Listing Service (MLS) listing knows the phone will ring off the hook with interested prospects.

- Reduced Closing Times

Another advantage of offering owner financing is substantially lower closing times. A closing involving a third-party conventional lender can take six to eight weeks while closing a seller-financed transaction through a reputable title company can take as little as two to three weeks. This is due to the reduced paperwork and less restrictive due diligence process.

- Investment Strategy for Hard to Finance Properties

There are many properties that encounter financing difficulties including mixed use property, land, mobile and land, non-conforming, low value, and others. Investors realize excellent returns by paying a reduced cash or wholesale price on a hard-to-finance property and then reselling at a higher retail price with easy financing terms.

- Interest Income

Why let the banks earn all the interest? Sellers can keep the property-earning income even after they sell by offering owner financing. For example, a $100,000 mortgage at 9 percent with monthly payments of $804.62 will pay back $289,663.20 over 30 years. That additional $189,663.20 (over the $100,000 mortgage) is power of interest income!

Work with Owner Financing Specialists

If considering seller financing, be sure to consult with a qualified professional to properly document the transaction.

It also helps to speak with note investors to gain insight on appealing terms and structuring techniques. This assures top-dollar pricing should you ever want to convert the payments to cash by assigning your note, mortgage, deed of trust, or contract to an investor.

We’ve Got Mail!

While we started out in real estate investing and note investing many years ago, our goal was to make a profit from a business. What we didn’t completely realize in the beginning how much fun we’d have by helping others buy a home, sell a house, be able to stay in their home, invest in real estate, or in notes. We couldn’t fully comprehend that we would be making an impact on people’s lives.

I remember when we stood in a driveway of a house in Federal Way, Washington. Marishka and I had just met with a couple who lived just a few blocks from the house. We had just arrived at a solution as to how they could purchase the house. With a sob in his throat, and tears in his eyes, Ed said “You don’t know how much this means to me and my family.” They had lived in the neighborhood for 17 years, had always rented, and as a home remodeler for others, he hadn’t seen much hope to buying a home. With some creative terms and sweat equity, Ed and his family were able to move into and buy the home. The thought that we were able to help them still brings me pride joy.

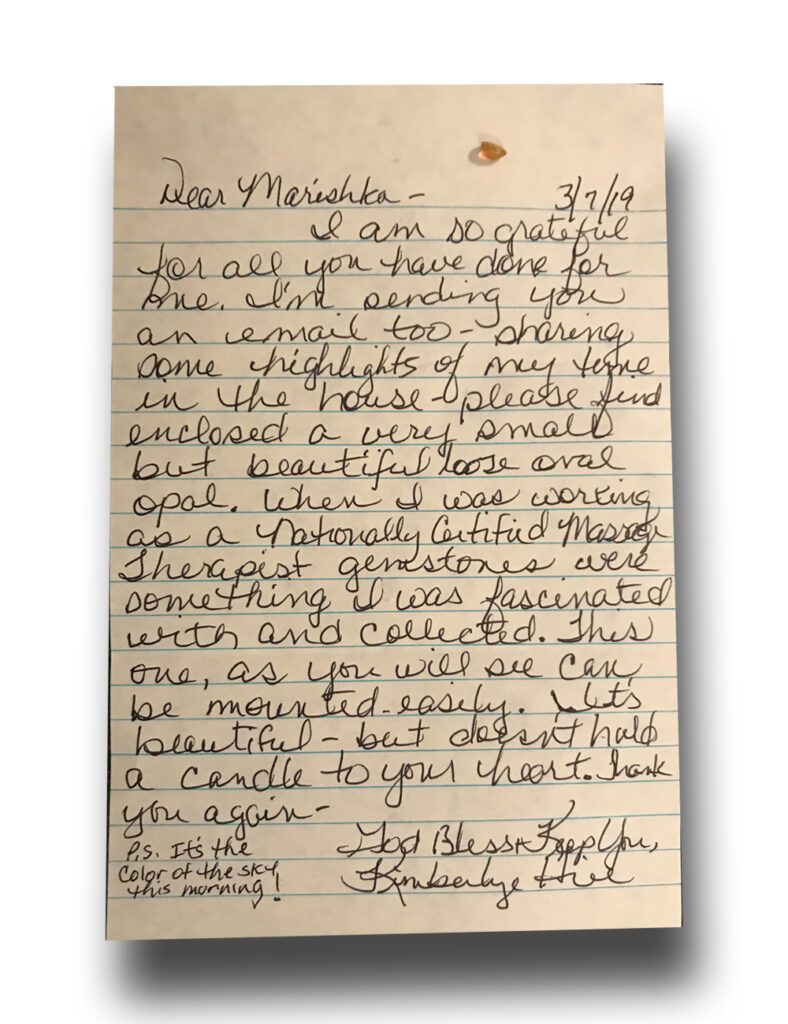

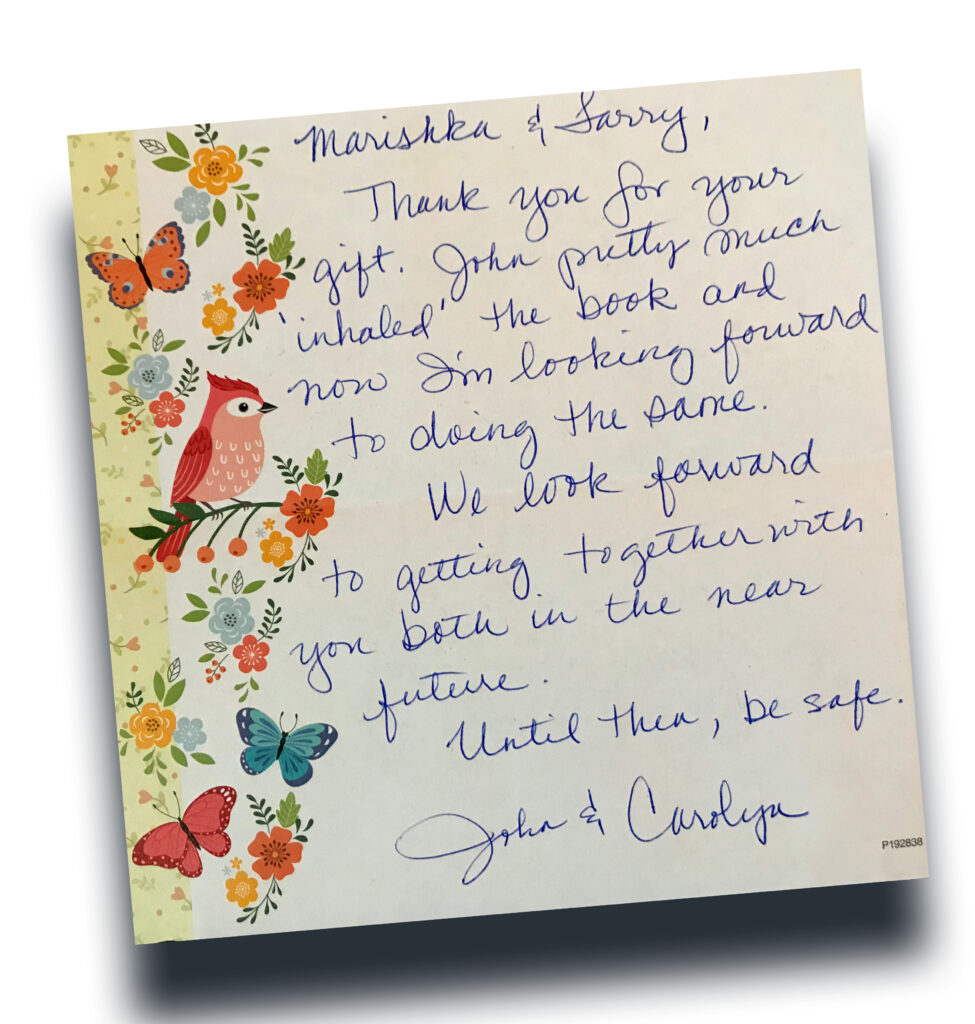

We get a lot of referrals and repeat business. We truly are blessed with the folks we are able to work with, and when we get a thank you note unexpectedly in the mail, it humbles and honors us that we’re able to help. I just wanted to share a couple of those notes.

The first thank you is from a woman who could not afford to keep her house any longer. We were the lender on the home. By the way, Marishka is a saint. When it was apparent that the payments had stopped, Marishka spent hours on multiple phone calls with Kimberly, mainly listening to her in a patient and compassionate way. She gave her ideas on how she may be able to qualify for some assistance, or perhaps her daughter could purchase the house. In the end, Kimberly asked “Can I just give you back the house?” We did a deed in lieu of foreclosure so her credit would not be impacted. We send her the documents to sign and in the return envelope we received this very thoughtful thank you, along with a gem stone. To say the least, Marishka was in tears this time. A chapter in Kimberly’s life was closed and she was able to move on.

We love sharing books and resources that we’ve read and found valuable in our business. While note and real estate investing can be complicated and perhaps confusing, a book can sometimes help clear up some of the mystery. Feel free to ask if we have any favorite books to share.

To Your Success,

Larry

Let Real Wealth Doctor Help You Create Financial Freedom...and make work optional.

CONTACT US

Real Wealth Doctor

PO BOX 175

Coeur d’Alene, Idaho 83816

208-758-4133

Disclaimer: Information provided for informational purposes only. Please seek competent legal, tax or investment advice as appropriate. All Investments involves risk and possible loss of principal.

© 2021 Real Wealth Doctor